Undisclosed Income or Expenditure Under the Income‑tax Act – Know the Rules & Penalties

Finding money or spending that you can’t explain in your tax returns can land you in serious trouble. In India, the Income‑tax Act has specific rules for dealing with such undisclosed income or expenditure. This guide explains what it means, how it’s taxed, and what penalties you could face.

Table Of Content

- What Is Undisclosed Income or Expenditure?

- Why These Rules Exist

- How Undisclosed Income Is Taxed

- Penalties You Might Face

- How to Avoid These Issues

- FAQs on Undisclosed Income or Expenditure

- What’s the difference between Sections 68 and 69?

- What is unexplained expenditure under Section 69C?

- How is undeclared income taxed?

- What penalties apply on top of this tax?

- Can I avoid these rules if I explain later?

- Final Thoughts

What Is Undisclosed Income or Expenditure?

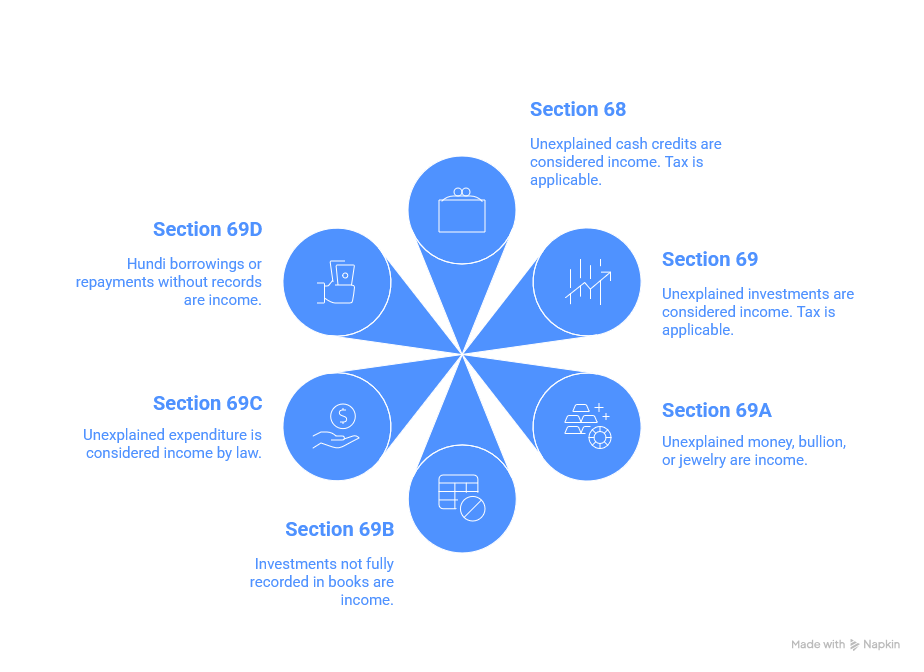

Undisclosed income or expenditure refers to any money credited, investment made, or spending incurred without a clear source or proper documentation. The law views this as deemed income under different sections:

- Section 68 – Unexplained cash credits

- Section 69 – Unexplained investments

- Section 69A – Unexplained money, bullion, jewelry

- Section 69B – Investments not fully recorded in books

- Section 69C – Unexplained expenditure

- Section 69D – Hundi borrowings or repayments without records.

If you cannot provide a believable explanation or proof, this amount is added to your taxable income.

Why These Rules Exist

These sections prevent people from hiding money or laundering black money through bogus transactions. If amounts are flagged during assessment and can’t be clarified, they are treated as taxable income

How Undisclosed Income Is Taxed

Once added to your income under Sections 68–69D, this amount is taxed at a flat 60%, plus:

- 25% surcharge

- 4% health & education cess

The combined tax rate is a steep 78% and no deductions are allowed

Penalties You Might Face

On top of the tax, additional penalties may apply:

- Section 271AAC – A 10% penalty on the tax if undisclosed income is detected during assessment.

- Section 271AAB – For undisclosed income found during search or seizure, penalties range from 30% to 90% of tax payable, depending on admission or concealment level.

In total, you could end up paying over 137% of the undisclosed amount in taxes and penalties.

How to Avoid These Issues

- Maintain proper records – Keep invoices, receipts, bank statements for all transactions.

- Explain large credits or investments – Provide proof or source for significant deposits or expenses.

- File transparently – Disclose all transactions in your return even if late, to avoid penalties.

- Be audit-ready – If you receive notices, cooperate and share documents promptly.

A genuine explanation can remove the addition and save you from heavy tax and fines.

FAQs on Undisclosed Income or Expenditure

What’s the difference between Sections 68 and 69?

Section 68 deals with unaccounted cash credits in your books, while Section 69 targets unexplained investments not recorded.

What is unexplained expenditure under Section 69C?

If you spend money without explaining the source, that expenditure can be treated as deemed income for that year.

How is undeclared income taxed?

At a flat 60% under Section 115BBE, plus surcharge and cess – total effective rate ~78%. No deductions apply.

What penalties apply on top of this tax?

Using Section 271AAC, a 10% penalty on tax is charged, and for cases found in searches, up to 90% under Section 271AAB.

Can I avoid these rules if I explain later?

Yes. If you voluntarily disclose and provide proof before the assessment, you can avoid additions and penalties.

Final Thoughts

Undisclosed income or unexplained expenditure can trigger severe penalties. Understanding sections 68–69D and Section 115BBE helps you stay compliant. Keep records, explain transactions, and file honestly to avoid major tax issues and penalties.