Selling Property in India? Here’s What the 2024 Tax Changes Mean for You

Understand how taxation on sale of immovable property changed from 23 July 2024 – indexation, rates, TDS, Section 50C & grandfathering explained with examples.

Table Of Content

- Introduction: What’s at Stake When You Sell Property?

- Background: Understanding Property Tax Basics | Tax on Sale of Immovable Property

- Important Changes Effective from 23 July 2024

- 1. Section 50C Amendment

- 2. LTCG Rate & Indexation

- Long-term Capital Gain Tax Rates on sale of Property

- 3. Grandfathering Provision

- 4. TDS & Reporting Norms

- Lats understand with Example: Assumption

- LTCG Tax Calculation – Immovable Property

- Key Takeaways

- Pros and Cons: Winners and Losers

- Actionable Takeaways

- Conclusion & Final Thoughts

- Questions? Answers.

Introduction: What’s at Stake When You Sell Property?

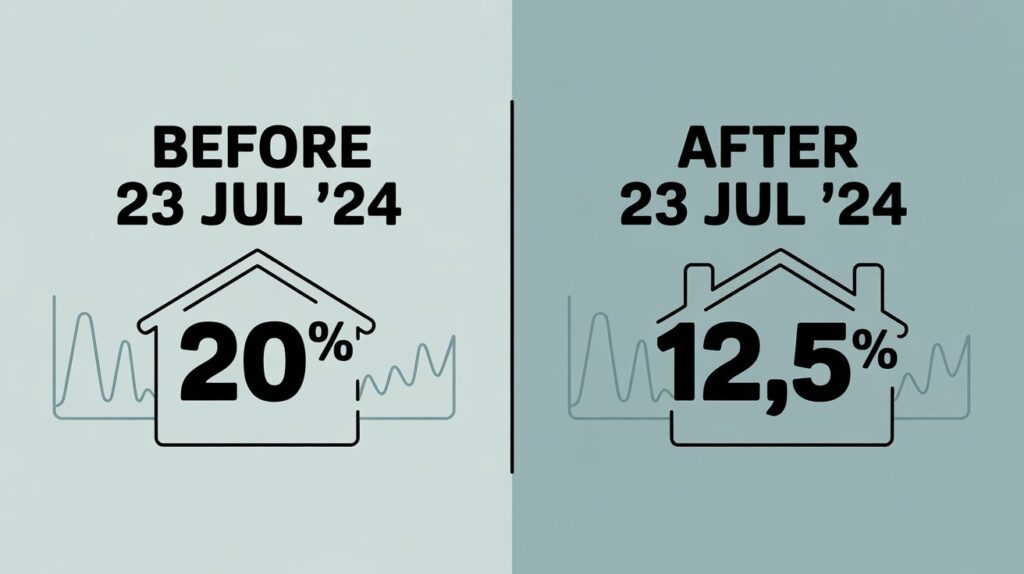

Did you know that before 23 July 2024, long-term capital gains (LTCG) on house property were taxed at 20% with indexation, but now they are taxed at a flat 12.5% without indexation for assets bought on or after that date? If you’re planning to sell your home or land, these changes can add or save you lakhs. Let’s understand these changes in rules of tax on property.

Background: Understanding Property Tax Basics | Tax on Sale of Immovable Property

When you sell a property like a house, plot, or shop – the profit you make is taxed with capital gains tax. In India, this gains are taxed under Section 45 of the Income Tax Act 1961. There is two types of Capital Gains.

- Short-Term Capital Gains (STCG): Assets Sell within 24 months, and your profit gets taxed at your regular income tax slab rate.

- Long-Term Capital Gains (LTCG): Assets Hold for more then 24 months, historically taxed at 20% with indexation benefit (to adjust for inflation).

Before 2024, LTCG on property sales came with a 20% tax rate with indexation. What is that? It’s a way to adjust your original purchase price for inflation, minimize your taxable profit. But the 2024 Budget change the rules for indexation for assets sales after July 23, 2024, replacing it with a flat 12.5% rate. Sound simple? It’s not always a win – let’s see why.

Important Changes Effective from 23 July 2024

1. Section 50C Amendment

- Before 23 July 2024: Deemed sale price = higher of agreement value or circle rate.

- After 23 July 2024: Same rule, but indexation benefit only for properties acquired before 23 July 2024. Properties bought on/after lose indexation entirely.

2. LTCG Rate & Indexation

| Holding Period | Sell Before (pre-23 Jul) | Sell After (post-23 Jul) |

|---|---|---|

| > 2 years | 20% with indexation | 12.5% without indexation or 20% with indexation for pre-23 Jul property (taxpayer’s choice). |

| ≤ 2 years | Slab rate (normal income tax) | Unchanged |

Long-term Capital Gain Tax Rates on sale of Property

- Acquired and sold before 23rd July 2024: 20% with indexation benefit

- Acquired and sold after 23rd July 2024: 12.5% without indexation

- Acquired before 23rd July 2024 and Sold after 23rd July 2024: 12.5% without indexation

or 20% with indexation (Taxpayers Choice)

3. Grandfathering Provision

- Properties Sold after 23 July 2024: Taxpayers may opt for the old 20% + indexation regime or switch to the new 12.5% slab – whichever yields lower tax.

- Properties sold before 23 July 2024 purchases: Only 20% with indexation applies.

4. TDS & Reporting Norms

- TDS on property sale by Buyers: 1% TDS (if sale consideration > ₹50 lakh) remains unchanged.

- Annual Reporting: Both parties must file Form 26QB/26QC within 30 days of TDS deduction; stricter penalties for late filing.

Lats understand with Example: Assumption

Long-Term Capital Gains (LTCG) tax calculation table for immovable property (land/building) in India, considering both before and after 23 July 2024 rules (as per the Finance Act, 2024):

| Particulars | Details |

|---|---|

| Date of Purchase | 01-April-2010 |

| Date of Sale | 10-October-2025 |

| Purchase Price | ₹30,00,000 |

| Sale Price (Actual) | ₹1,00,00,000 |

| Stamp Duty (Circle) Value | ₹1,05,00,000 |

| Improvement Cost (FY 2015) | ₹5,00,000 |

| CII in FY 2010-11 (Base) | 167 |

| CII in FY 2015-16 | 254 |

| CII in FY 2025-26 | 363 |

| TDS u/s 194-IA | 1% by buyer if sale > ₹50 lakhs |

LTCG Tax Calculation – Immovable Property

| Particulars | (Before 23 Jul 2024 rule) | (After 23 Jul 2024 – No Indexation) |

|---|---|---|

| 1. Sale Consideration (higher of actual/circle rate) | ₹1,05,00,000 | ₹1,05,00,000 |

| 2. Indexed Cost of Acquisition | ₹30,00,000 × 363 ÷ 167 = ₹65,20,958 | Not applicable |

| 3. Indexed Cost of Improvement | ₹5,00,000 × 363 ÷ 254 = ₹7,14,566 | Not applicable |

| 4. Total Indexed Cost | ₹72,35,524 | Not applicable |

| 5. LTCG (Sale − Indexed Cost) | ₹1,05,00,000 − ₹72,36,911 = ₹32,64,464 | ₹1,05,00,000 − ₹35,00,000 = ₹70,00,000 (Assume purchase in 2025) |

| 6. Tax Rate | 20% + 4% cess | 12.5% + 4% cess |

| 7. LTCG Tax Payable | ₹32,64,464 × 20.8% = ₹6,79,008 | ₹70,00,000 × 13% = ₹9,10,000 |

Key Takeaways:

- Indexation benefit is available only for properties acquired before 23 July 2024.

- You can choose the regime that offers lower tax liability if your property was purchased before that date.

- Flat 12.5% tax rate (plus cess) applies to property purchased on or after 23 July 2024, no indexation allowed.

Pros and Cons: Winners and Losers

The new tax setup is not black-and-white. Here’s the scoop:

Pros:

- Lower rate: 12.5% beats 20% for properties with low appreciation.

- Less hassle: No indexation math means simpler filings.

Cons:

- Bigger gains, bigger tax: Long-held properties face heftier taxable profits.

- Inflation sting: No adjustment for rising costs could hurt in high-inflation years.

Short-term flippers might cheer, but long-term holders? Not so much.

Actionable Takeaways

- Check Your Acquisition Date: Identify if your property falls before/after 23 July 2024.

- Compute Both Regimes: For pre-23 Jul properties, run tax calculations under both methods to pick the lower tax.

- Maintain Stamp Duty Records: Accurate circle rate documentation ensures compliance under Section 50C.

- Plan Sale Timing: If feasible, consider delaying sale until post-indexation acquisitions for a lower flat rate.

- Stay Compliant on TDS: Ensure 1% TDS deduction and file Form 26QB on time to avoid penalties.

Conclusion & Final Thoughts

The 23 July 2024 reforms aim to simplify capital gains on property while offering potential tax savings. By understanding indexation limits, rate choices, and TDS obligations, you can optimize your sale strategy and pocket more of your hard-earned gains.

Questions? Answers.

12.5% flat for assets bought on/after 23 July 2024; Before-23 July assets can choose either 12.5% or 20% + indexation

It sets the deemed sale price as the higher of sale consideration or circle rate for capital gains calculation

Yes – if you acquired and sold the property before 23 July 2024 20% with indexation benefit. After that date, 20% with indexation and 12.5% without indexation.

No – the 1% TDS (on transactions > ₹50 lakh) remains the same under Section 194IA.

Late filing attracts penalty under Section 234E (₹200/day) and interest on TDS dues; file within 30 days

Refer to the Finance Act (No. 2), 2024 and CBDT circular dated 23 July 2024 on the Ministry of Finance websit

Tags:

Income Taxtaxreaders

Your one-stop destination for everything finance! Our blog covers a wide range of topics including Income Tax, GST updates, Stock Market trends, Company Law insights, Business news, and in-depth analyses of Economics and Personal Finance. Whether you're a professional, investor, business owner, or someone looking to manage your money better, we provide easy-to-understand, expert-backed content to keep you informed and ahead in the financial world

Follow Me